Is the AJ Resale Market Oversaturated? Unearthing Hidden Gems with the AcBuy Spreadsheet Strategy

The Air Jordan (AJ) resale market has long been a goldmine for sneakerheads and resellers alike. However, with increasing competition and hype models dominating platforms like StockX and GOAT, many wonder: Has the AJ market reached saturation?AcBuy Spreadsheet

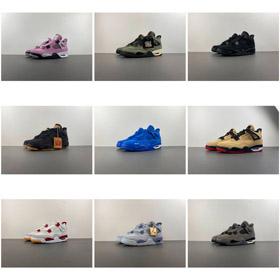

Popular AJ retros (e.g., Jordan 1 Highs, 4s, or 11s) face fierce bidding wars, squeezing profit margins. Meanwhile, rare collabs (Travis Scott, Off-White) demand unrealistic upfront capital. But buried beneath the noise are overlooked models—think AJ2s, AJ9s, or women’s exclusives—with stealth ROI potential. In 2023, AcBuy’s spreadsheet identified the Jordan 2 “Just Don” (a 2015 release) as a sleeper hit. Resell prices surged 140% after ESPN featured them in a vintage sneaker segment. Early adopters who purchased at $400 (pre-spike) resold for $950+. "The spreadsheet’s algo found AJ5 ‘ICE Blues’ sitting at outlets. Two months later, a YouTube review triggered a 60% price jump." —@ResellRaven (Twitter) While mainstream AJ reselling feels overfished, saturation is myth if you dig deeper. Tools like AcBuy’s spreadsheet spotlight under-the-radar gems—combining data analytics with old-school sneaker passion. Ready to hunt?The Saturation Dilemma

How the AcBuy Spreadsheet Works

Case Study: AJ2 “Just Don”

3 Key Cold-Style Criteria

Pro Tips to Avoid Pitfalls